At a Glance

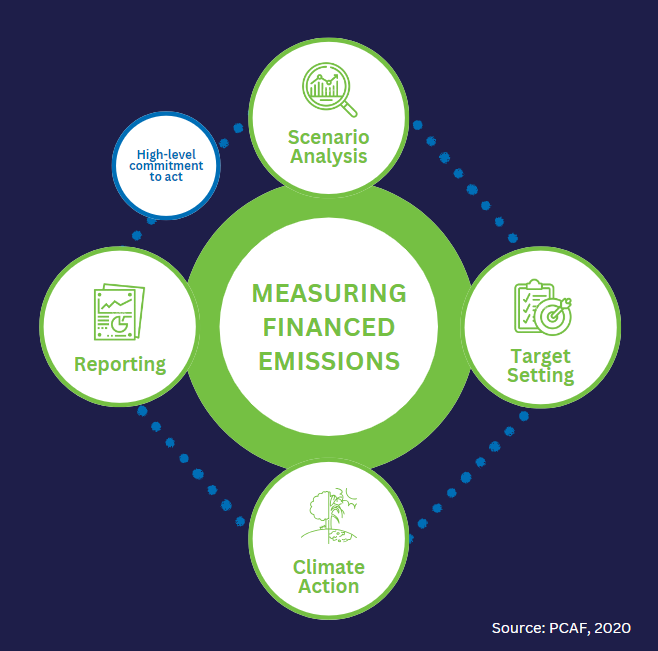

- Measuring financed emissions is a practical initial step for financial institutions to demonstrate their commitment to sustainability and identify climate-related risks.

- Complexities and importance of financed emissions measurement, highlight the role of the Partnership for Carbon Accounting Financials (PCAF) in standardising and evolving methodologies within this realm.

- PCAF’s growing influence offers FIs a robust framework for navigating financed emissions and ESG commitments.

The assessment of financed emissions has emerged as a pivotal aspect, holding significance for commercial banks, insurance companies, and asset managers collectively referred to as financial institutions (FIs). FIs are under growing scrutiny from regulatory bodies, the public, and their clients to be more transparent regarding their involvement in climate change and other sustainability matters. Many FIs now recognise the importance of actively contributing to the sustainability transition in the real economy. Measuring financed emissions represents a practical initial measure to demonstrate their commitment to incorporating climate change considerations into their core activities of capital provision and allocation. Furthermore, financed emissions could serve as an indicator of the potential risks associated with transitioning to a more sustainable economy due to climate change. Currently, disclosing financed emissions is typically voluntary worldwide, with the exception of the European Union, where it is mandatory.

Voluntary disclosures of financed emissions enhance transparency to investors. When financial institutions willingly share data on the emissions associated with their investments, it fosters trust and confidence among investors who increasingly consider environmental factors in their decision-making. By voluntarily disclosing financed emissions, financial institutions can attract environmentally conscious investors, potentially leading to increased investment and improved market perception.

Measuring financed emissions provides crucial data for setting and tracking environmental targets. Financial institutions can use this information to establish emission reduction goals, aligning their strategies with global efforts to combat climate change. Accurate measurements of financed emissions serve as the foundation for setting realistic and impactful targets.

Financed emissions measurement serves as a key component of an FI’s risk management profile. By understanding their exposure to carbon-intensive investments, financial institutions can assess and mitigate climate-related risks, safeguarding their long-term financial stability. Financial institutions that measure financed emissions are better equipped to identify and manage these risks, ensuring resilience in the face of an evolving climate landscape.

Challenges with Financed Emissions

FIs face challenges in applying accounting standards consistently across diverse portfolios and various financial instruments. These standards can vary significantly, making it difficult to ensure uniformity in emissions calculations. Financial portfolios often include a wide range of assets and investments with varying accounting requirements. Harmonising these standards for emissions measurement is a complex task.

FIs will need to conduct an in-depth analysis of carbon exposures within their portfolios to meet enhanced climate risk disclosure requirements. This analysis can be time-consuming and resource intensive. FIs must invest in the necessary resources and expertise to comply with these requirements effectively.

Emissions data within portfolio projects and businesses is often incomplete or inconsistent in some asset classes and entirely absent in others. Gathering accurate and reliable emissions data can be a formidable challenge for financial institutions. Processing financed emissions data from various sectors and businesses with diverse exposures can be technologically challenging. Integrating data from different sources and formats requires a robust transformational approach.

Partnership for Carbon Accounting Financials (PCAF) to address Financed Emissions

Complexities and importance of financed emissions measurement, highlight the role of the Partnership for Carbon Accounting Financials (PCAF) in standardising and evolving methodologies within this realm.

PCAF operates as an industry-led partnership guided by a Steering Committee comprising ABN AMRO, Amalgamated Bank, ASN Bank, the Global Alliance for Banking on Values, Morgan Stanley, NMB Bank, Triodos Bank, and a United Nations-convened Net-Zero Asset Owner Alliance representative. Presently, PCAF receives participation from more than 340 FIs, and $85 Trillion worth of assets underlining its growing influence and relevance.

PCAF’s Global Acceptance and Influence

Since its inception, the Standard has garnered substantial attention and adoption globally. By November 2022, over 340 FIs from more than 45 countries had committed to measuring and disclosing emissions associated with their financial activities. This growing uptake of PCAF’s methodologies has led financial regulators and other stakeholders to consider PCAF as the de facto standard for accounting and disclosing the climate impact of portfolios.

PCAF and the Global GHG Accounting and Reporting Standard

Addressing the industry’s demand for a universal, standardised approach to gauge and report greenhouse gas (GHG) emissions linked to financial activities, PCAF introduced the Global GHG Accounting and Reporting Standard for the Financial Industry, known as “the Standard,” in November 2020. Developed by a diverse, global team of financial institutions for financial institutions, this Standard merge deep industry insight with the rigor of the GHG Protocol, recognised for providing the world’s most widely used GHG accounting standards.

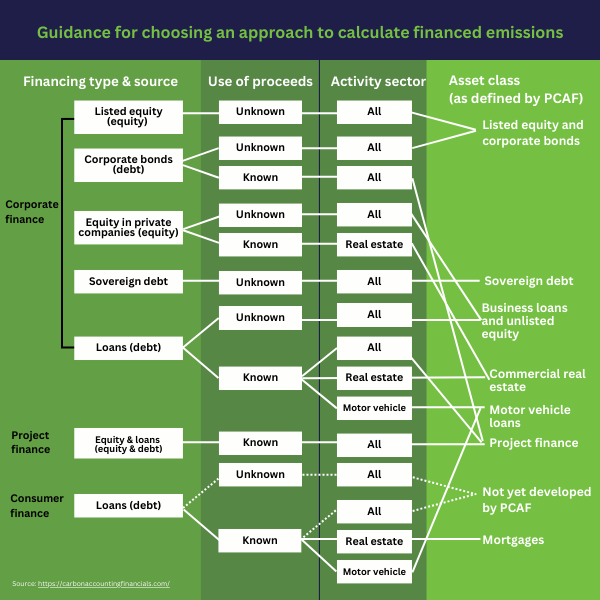

The Standard offers comprehensive methodological guidance for quantifying and disclosing GHG emissions associated with six asset classes: listed equity and corporate bonds, business loans and unlisted equity, project finance, commercial real estate, mortgages, and motor vehicle loans. Its introduction has initiated a significant transformation in how FIs assess their climate impact.

PCAF and the Task Force on Climate-related Financial Disclosures (TCFD) and IFRS

The Task Force on Climate-related Financial Disclosures (TCFD) has endorsed PCAF’s methodology for measuring GHG emissions related to financial activities. In its Proposed Guidance on Climate-related Metrics, Targets, and Transition Plans, TCFD recommends FIs to employ PCAF’s methodology. With TCFD becoming mandatory in multiple countries alongside IFRS S2, FIs can rely on PCAF for harmonised and robust approaches to measure and report these emissions.

Is CSR still relevant in a world dominated by ESG?

A new frontier of Operational Excellence: ESG Reporting

Ready for a change in your organisation?

Understanding the PCAF Standard: A Closer Look

The Global GHG Accounting & Reporting Standard PART A from PCAF offers a detailed methodology for calculating financed emissions within FIs. The figure below from the standard provides guidance on selecting the appropriate approach for calculating financed emissions, ensuring that FIs can tailor their measurement methodologies to suit their specific needs and portfolios.

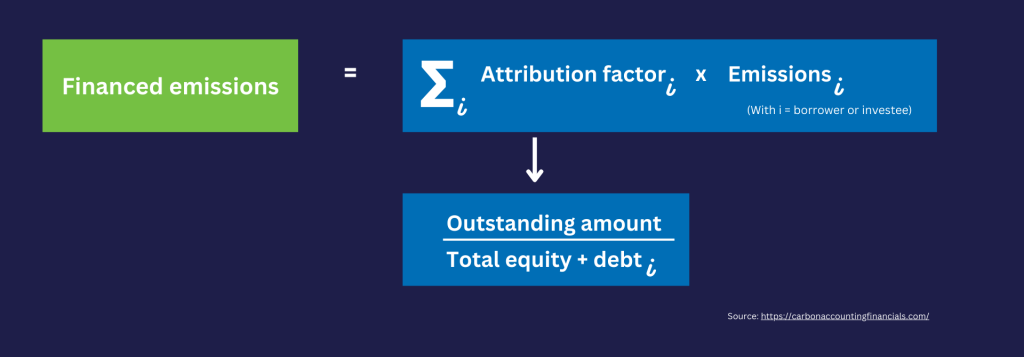

Furthermore, the standard outlines a comprehensive methodology for each approach to calculating emissions, accompanied by clear reporting requirements. This clarity empowers FIs to accurately assess and transparently report their climate impact, fostering greater accountability within the industry. Thereafter, a General Approach to Calculate Financed Emissions using PCAF Standard employs the following formula to calculate financed emissions, consisting of two main components:

- Emissions of the Investee Company: Initially, the calculation involves estimating the emissions of the investee company. This can be achieved by using sector-based standard estimates or relying on reported data from the investee company. The level of accuracy in these estimates is transparently disclosed through the use of PCAF scores.

- Attribution to Investor or Lender: The second part of the calculation determines the proportionate share of emissions attributable to the investor or lender. This is done using an attribution factor, which quantifies how much of the investee company, and consequently its emissions, has been financed by the investor or lender.

Financed emissions measurement has evolved into a critical component of financial institutions’ efforts to address their environmental impact. The PCAF Standard has emerged as a pioneering and globally accepted methodology for quantifying and disclosing these emissions. As regulators, investors, and stakeholders increasingly emphasise transparency and accountability in climate reporting, the influence of PCAF and its Standard continues to grow, offering a robust framework for FIs to navigate the complexities of financed emissions and their broader ESG commitments.

How Renoir Can Facilitate

Renoir, as a trusted partner in the Environmental, Social, Governance (ESG) journey, brings specialised expertise and extensive experience in the finance sector to support FIs. The services offered by Renoir include:

- Strategic and Operational Guidance: Leveraging cross-functional expertise to provide strategic and operational guidance, sharing in-depth knowledge of finer details in ESG and decarbonisation of financial Institutions and their portfolios.

- Global Expertise: Providing guidance and representation across the global portfolios, supply chains and industry, drawing on a wealth of multinational expertise.

- Risk and Opportunity Assessment: Conducting thorough assessments of potential risks and opportunities stemming from financed emissions and other ESG-related aspects, aiding FIs in informed decision-making.

- Portfolio Emissions Modelling: Developing financed emission management strategies for FIs that align with climate and emission reduction targets while balancing growth projections and risk objectives, related to future global decarbonisation rates.

- Emissions Due Diligence: Developing frameworks and conducting due diligence for key transactions and lending products, ensuring alignment with material stakeholder expectations and applicable standards.

- Emissions Reporting: Assisting with compliance, materiality assessments, and strategic communications enabling FIs to convey their commitment on their financed emissions and progress on their reduction targets.

- Capacity Building and Training: Offering capacity development and training at all organisational levels, covering various aspects of ESG including financed emissions and their far-reaching impacts.

Imad Alfadel is the Managing Partner ESG Practice at Renoir Consulting. With over two decades in the financial and consulting sectors, Imad has been supporting companies in enhancing their ESG performance. Through a hands-on approach at Renoir, he supports clients in realizing their ESG ambitions and transforming them into tangible results.

Jagpreet Walia is Partner ESG at Renoir Consulting. As a techno-strategic expert, he has experienced working with clients across emerging and developed markets, leading sustainability, green finance, adaptation, climate risk and decarbonization programs across public and private sectors. His expertise to empower businesses to thrive with collaboration and innovation helps in delivering sustainable impactful results.

Collaborate with Renoir to implement sustainability standards and drive positive change.